Blockchain in FinTech – Ensuring Next-Generation Financial Security

The FinTech industry is evolving at a great pace and new technologies are the reason behind this revolution. Blockchain is introducing new possibilities in the financial industry. It is changing the complete business landscape when it comes to finances. According to Statista, blockchain is one of the major markets in the tech space that will reach a $32 billion mark in industry size by the end of 2023. The FinTech industry is the biggest consumer of this technology as it provides a better way for international transactions. This blog will discuss the importance of Blockchain technology in the fintech space.

What is the Importance of Blockchain In FinTech?

Blockchain works on a decentralised Peer-to-Peer (P2P) network and records the transactions on the public network which is tamper-proof and makes financial transactions more secure and transparent. One fun fact is that Blockchain technology has been here for over a decade, and it got the popularity it deserves only a few years back. The adoption of blockchain technology by the financial industry has given a new model to the business market known as Decentralised Finance (DeFi). This new technology leads to a new system of distributed transactions that occur on the blockchain networks that contribute to two important factors: uniformity and automation.

Uniformity

A DeFi network which is a major aspect of a blockchain protocol is distributed across different nodes also known as computing devices and maintains a copy of the entire ledger. This helps in keeping a uniform record of the data and all the transactions that take place. Businesses that employ blockchain have unalterable and uniform information for every financial record.

Automation

Automation is the second major upside of implementing a blockchain protocol. FinTech companies use automated services that help them execute all operations on a smart contract layer. It is a self-executing system that allows firms to scale their every operation that involves financial handling, from employees’ loan approval to all business payments.

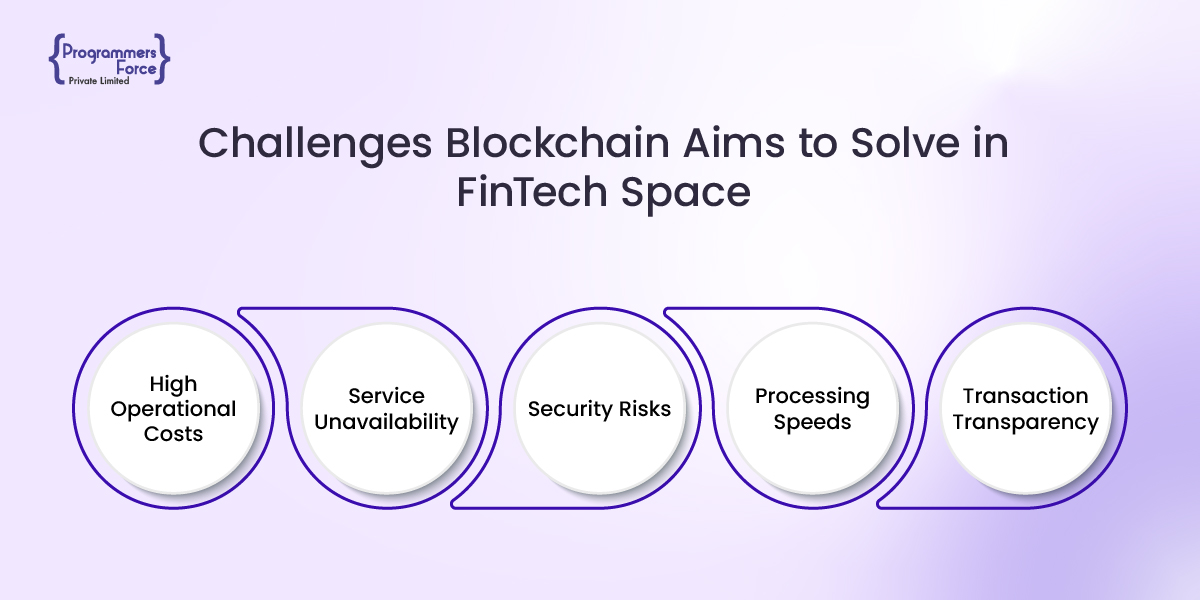

Solving Challenges in FinTech Space with Blockchain

How to solve all the financial challenges using blockchain technology that cause heavy impacts to financial businesses such as digital fraud. Even the full-scale financial systems are not perfect. Firms often have to deal with slow transaction processing, high fees of payments and the most prevalent issue, the lack of transparency. Blockchain systems can solve some of the most alarming issues discussed below:

High Operational Costs

The first issue that many FinTech players face is the high operational costs that they pay using their traditional financial processing systems. Blockchain technology can help in reducing these extra charges as it provides a straightforward way of processing multiple payments all at once. Blockchain uses a P2P processing system and aims to completely eliminate third-party middlemen from banking operations. This significantly improves the processing time and reduces the transaction costs for both ends, the fintech firms and their clients.

Service Unavailability

Service availability is the next factor that can limit the performance of the financial firm. One major example is the regulatory restriction in several areas of app usage when a user is travelling. It can worsen if the company lacks physical branches or remote support staff. With a blockchain system, a FinTech company can easily operate beyond borders without worrying about any regulatory restrictions of traditional and financial systems. A decentralised system allows smart contracts to continue operations whenever they want from anywhere around the world.

Security Risks

Another challenge that the Fintech industry faces is the issue of security control. For instance, an external cyber attack or an internal vulnerability can lead to weak access control exposing much important data to the public, which can cause significant damage to the employees and the client. Blockchain has a great solution to fix this issue as well. It comes with a number of integral tools and technologies. Immutability and encryption are the two most important blockchain offerings that help in taking security to the next level.

Processing Speed

The process of performing financial transactions takes time, especially when processing a large number of transfers for international receivers. The settlement times can range from a couple of hours to several days. This time is due to the manual processing of data and the involvement of several intermediaries in the way. Blockchain technology can also help in boosting processing speeds, making them much faster and more secure, to solve the major challenges of the financial sector. As it is designed on an immutable ledger system, it does not involve any intermediaries in the way and conforms to the payments on the go. It uses cryptographic tokens to verify the transaction and its author, ultimately reducing the settlement time.

Transaction Transparency

Improving traceability and transparency are the two best aspects of blockchain technology. The most prominent example of improved clarity is the cryptocurrency network. All the digital currencies work on the blockchain ledger system, which is encrypted through various security techniques such as cryptography. The whole transaction lifecycle is recorded from the sender to the receiver and all the nodes in between. It is an automated process and is performed using self-executing smart contracts. This decentralised system of transactions is fully-transparent, which makes it more resistant to security breaches.

Also Read about AI in Financial Industry.

How Programmers Force Can Help

Blockchain is one of the most trending keywords in the FinTech industry. It has seen enormous adoption in recent years, and many companies are exploring new ways of improving financial services using blockchain technology. All the FinTech startups that kick start their business venture utilise blockchain technology to transform the current banking system. The Programmers Force is envisioned to promote innovative ways in the FinTech trends and space. With our best-in-class technology offerings, we have helped many digital payments, trading, and lending platforms to start their business ventures in the world’s top competitive markets. Talk to our experts to get the best guidance for your next business idea.