How the Fintech Industry is Progressing in 2023

With the latest innovations in the finance and tech industry, the Fintech industry has become a driving factor for both. This combination of software and finance has completely revolutionised every business sector. This is the reason we experience a rise in Fintech startups all over the world. If we see closely, the era of the pandemic has played a significant role in promoting fintech development. Afterwards, the experimentations with predictive analysis, blockchain and artificial intelligence aided digital banking in no time. Now 79% of UK consumers use fintech apps to process payments and more than 49% stated that investing in fintech is a top goal. This blog will cover all essential fintech developments in today’s world, from open banking to embedded finance.

What is FinTech all About?

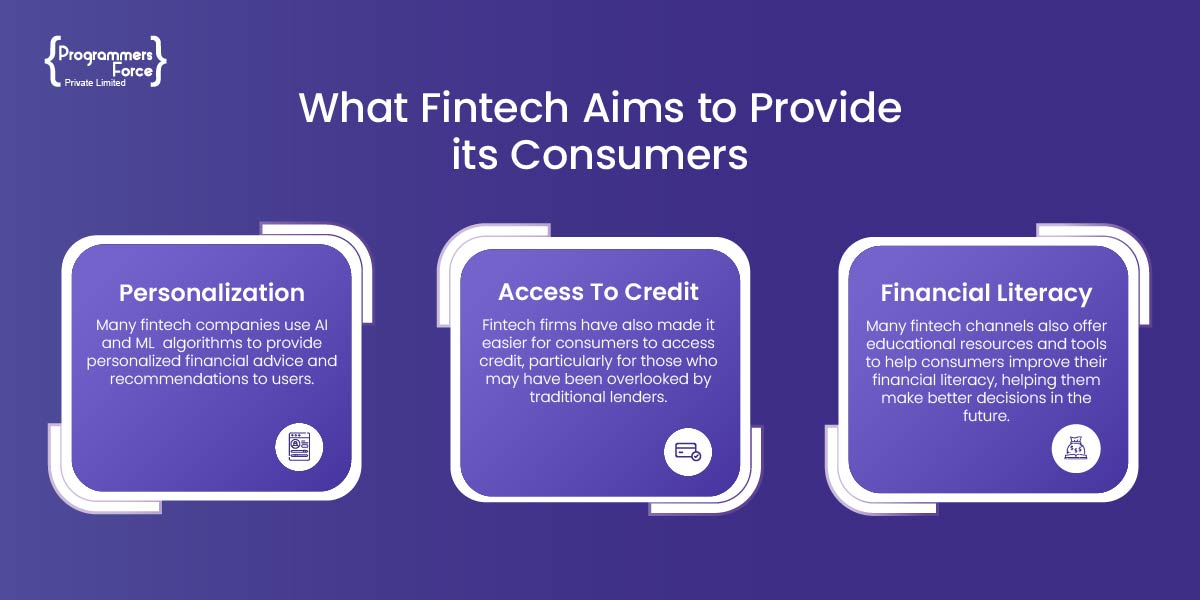

FinTech is reshaping the financial industry by employing cutting-edge digital technologies to provide faster, more efficient, and more accessible financial services. Fintech is changing the way we think about money, from mobile payment systems to automated advisors and blockchain-based transactions. Fintech is making financial services more accessible and inexpensive than ever before, thanks to its emphasis on innovation and user experience. Those who previously had restricted access to financial services, for example, may now manage their funds with ease thanks to mobile banking apps.

The Current Trends in FinTech – Quick Recap

The latest fintech innovations in the sector are proving significant in terms of exponential growth and expansion of finance operations. Today’s business industry is adopting the latest financial solutions to improve the transparency and security of its assets.

- One trending integration to the FinTech industry is embedded finance. It is a service which provides all digital financing options in areas with limited or least finance offerings. For instance, Amazon now offers on-demand financing right at the time of purchasing an item.

- Another trend is open banking solutions which prove to be a lifesaver for consumers, especially the unbanked communities. With open banking, consumers can access all financial services from third-party organisations that access their data through API keys. With its widespread adoption, the open banking market is expected to reach $43 billion by 2026.

How Does the Fintech Industry Work in 2023?

Having many advancements and innovations in the tech sector, the FinTech industry is constantly on the rise and will work its way to a worth of $174 billion by the end of 2023. The introduction of robo-advisors for investment advice and intelligent money management systems for large enterprises justify the numbers.

Today, the FinTech industry is utilising modern innovations such as artificial intelligence and machine learning to boost its expansion. It provides efficient solutions for a wide range of sectors across Business-to-Business (B2B), Business-to-Consumer (B2C), and Peer-to-Peer (P2P) markets. Other than the banking industry, FinTech has expanded its footprint to other economical grounds such as cashless payments, wealth management, accounting, cybersecurity, e-commerce and lending.

Modern FinTech application work using these technologies and platforms to offer the best value:

APIs

APIs (Applications Program Interfaces) are the keys that open the connection lock between the user’s bank account and the FinTech application. APIs let them securely connect to a FinTech solution for making transactions, managing funds and verifying their identities.

Mobile applications

Almost every FinTech company today offers a mobile application for FinTech operations. Whether it is for online trading, digital banking, transactions, saving and investments, a mobile application is an absolute necessity to provide instant and real-time interaction to the user.

Web Solutions

On top of the mobile app works web-based applications for most fintech companies. These solutions work as an alternative to mobile apps for performing all such operations.

Which Technologies Power Fintech in 2023

AI and ML

AI and Machine Learning (ML) are two of the most essential technologies driving the finance sector today. These technologies are being utilised to improve fraud detection, risk management, client experience, and a variety of other financial industry elements. AI and ML systems, for example, can scan enormous volumes of data to uncover patterns that people may miss, enabling more accurate forecasts and decision-making. We should expect even more advanced uses of AI and ML in FinTech in the future, such as tailored financial counselling and automated loan approval decision-making.

Big Data

Another technology that is revolutionising the financial business is big data. Fintech businesses may leverage the massive volumes of data created by financial transactions and client interactions to acquire insights and make better-informed decisions. Big data analytics may assist FinTech firms in identifying patterns, trends, and correlations in data, allowing them to deliver better goods and services to their clients. We may expect even more advanced big data analytics tools in the future that can process and analyse data in real-time.

Blockchain

This technology is transforming the way financial transactions are carried out. Blockchain uses a decentralised ledger system to make transactions quicker, more secure, and less expensive. Blockchain is being used by FinTech businesses to simplify payment processing, cross-border transactions, and even identity verification. We may expect even more blockchain applications in FinTech in the future, such as smart contracts, decentralised finance, and digital identity verification.

IoT

Smartwatches and sensors, for example, can collect data that can be utilised to deliver individualised financial advice and better risk management. IoT devices, for example, might collect data on a person’s spending behaviour and recommend methods to save or invest. We should expect even more IoT devices to be employed in finance in the future, as well as more advanced algorithms to evaluate the data collected.

What the Future Holds for Fintech Industry

With new technology on the horizon, the future of the financial business appears bright. Apart from breakthroughs in AI and ML, Big Data, blockchain, and IoT, we may anticipate further innovations such as digital currencies, a greater emphasis on cybersecurity, and enhanced regulatory frameworks.

FinTech firms will continue to disrupt traditional financial institutions by offering better and more creative products and services to clients. Nevertheless, with this innovation comes the necessity for responsible technology and regulatory usage to secure consumers’ privacy and financial information.

As more devices become internet-connected, the FinTech sector may investigate new methods to use these devices for financial services. For example, IoT devices might give real-time data on customer behaviour, allowing businesses to provide more tailored financial advice and solutions.

How Programmers Force Can Help

As of 2023, the FinTech sector has experienced substantial development and innovation, fueled by technological breakthroughs and rising demand for digital financial services. The Programmers Force is contributing to its development by devising innovative FinTech applications that drive the industry towards new avenues of success. We ensure that our software fulfils all business requirements and intelligently takes their financial offerings to new levels by analysing and safeguarding their data. If you are looking for fintech solutions tailored specifically for your business contact us now.