AI in Financial Services: Growing Impact and its Importance

Artificial intelligence is the new talk of the town as it is the most recent technology development. AI is revolutionising many aspects of our lives, and financial operations are no exception. Finance professionals now have access to technologies that can help them make better decisions more quickly thanks to the development of big data and machine learning algorithms. AI is altering the way finance functions, from fraud detection to risk management. Many financial firms have already adopted AI operations in several departments. Stats from previous years indicate the rise in the implementation of AI technology in the financial sector with 35% of firms having fully deployed AI in their operations.

In this post, we’ll look at how artificial intelligence is currently influencing financial operations and what we might expect to see in the future. So, let’s get started!

What is AI? A Quick Overview

As everyone is aware that computers are becoming more efficient day by day. But what’s driving them to exceptional levels of performance and accuracy? Behind this whole phenomenon lies artificial intelligence. AI is the power that enables machines to execute activities that would normally require human intellect, such as visual perception, voice recognition, decision-making, and problem-solving. Mimicking human actions accurately is what differentiates this technology from others. Artificial intelligence is under use in almost every sector from healthcare to finance and it has the potential to revolutionise human living and working, and we are only scratching the surface of what’s possible.

Are Fintech and AI in Finance Same?

Fintech and artificial intelligence in finance are not similar, yet they are closely connected. Fintech, which stands for financial technology, is the use of technology to enhance and automate financial services. Fintech encompasses a diverse variety of technology and services, such as mobile payments, blockchain, digital currencies, robo-advisors, and others.

AI in finance, on the other hand, refers to the application of artificial intelligence technology to improve financial services. AI may assist in automating regular processes, improving fraud detection and risk management, and providing tailored customer care, among other things.

Whilst fintech spans a larger spectrum of technologies, AI is one of many techniques available to fintech businesses to improve financial services.

What Do the Financial Experts Say?

Artificial intelligence is a broad concept and every industry applies its own definition to distinguish this technology from other software systems. The AI Public Private Forum (AIPPF) – a forum set up by the Bank of England and the Financial Conduct Authority (FCA) – recently adopted the International Organisation for Standardization (ISO) definition of AI which describes it as “an interdisciplinary field, usually regarded as a branch of computer science, dealing with models and systems for the performance of functions generally associated with human intelligence, such as reasoning and learning”.

In today’s world firms are expecting to deploy AI solutions and are curious to find out whether a specific regulation will be introduced on this technology across several regions such as the UK. The lawmakers are scrutinising new plans to implement in the law including the EU AI Act. All these developments across the finance sector focus on addressing various issues such as transparency, explainability and governance. But the laws will only apply to technology that fulfils the definition of AI.

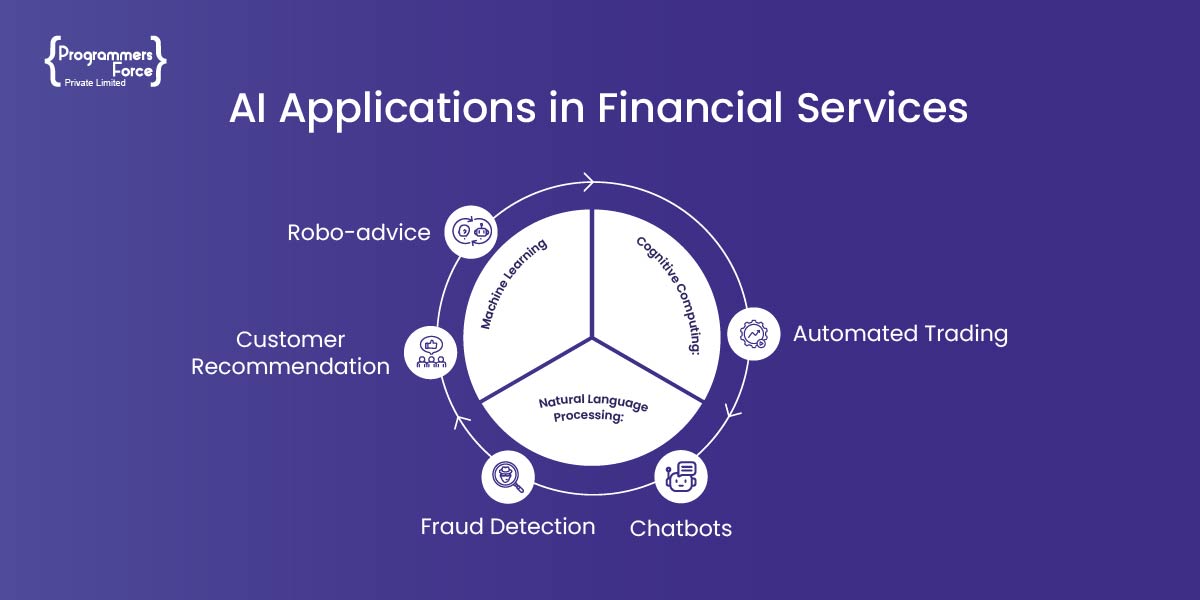

How AI can Impact the Financial Industry

Automation is one of the most major ways AI is influencing finance. AI-powered systems can do regular activities like data input, account reconciliation, and even transaction processing with more accuracy and speed than humans. This enables financial experts to concentrate on more difficult activities requiring human judgement and decision-making.

- Risk Management: Artificial intelligence assists banks and other financial organisations in assessing risk by analysing data and spotting trends that people may overlook.

- Trading and Investing: AI is rapidly being utilised to automate trading tactics and make investment judgements based on data and machine learning algorithms.

- Cost Reduction: By automating everyday jobs and optimising procedures, AI can assist financial organisations in reducing expenses.

- Predictive Analysis: AI can assist forecast future market patterns and discover possible investment opportunities.

- Regulatory Compliance: By evaluating massive volumes of data and reporting any possible problems, AI can assist assure regulatory compliance.

Implementing AI in Banking and Finance

The first step in working towards compliance with artificial intelligence is figuring out any potential implementation within a running organisation. Businesses that offer financial services should look out for the areas where they can successfully deploy AI solutions. Financial institutions can identify the need for AI by looking at various details on currently deployed systems and then comparing them with AI-powered solutions. Understanding the impact can have significant weight when implementing AI into the system.

The AIPPF identifies characteristics such as “the complexity of AI, its iterative approach, the use of hyperparameters, and the use of unstructured datasets” as components which can decide whether AI is required.

Another prime example of using AI banking is Germany’s central bank and financial regulator, Bundesbank and BaFin which have taken a similar approach. In the process, both authorities have avoided specifically defining AI or machine learning, a sub-branch of AI. Instead, they rolled out a set of properties which can help in determining the scope of AI in their financial duties and offerings.

Future of AI in Finance

Consider receiving individualised investment advice from a chatbot that learns your preferences over time, or having a virtual assistant that can swiftly answer banking queries and aid you in making financial decisions. AI certainly has the potential to revolutionise the banking and financial sector in a number of exciting ways. With regulators and financial firms recognising the importance of AI, the governance of this technology will be central to preparing new regulations and compliance procedures. For most financial services businesses and regulatory development authorities, AI is expected to shape new venues across the financial industry.

How Programmers Force Can Help

The Programmers Force holds a prominent role in creating AI solutions for financial businesses. We have expertise in developing custom software solutions and by working closely with financial institutions to understand their specific needs and challenges, we ensure to provide them with the right AI products. We leverage the knowledge of AI technologies, such as machine learning and natural language processing, to create innovative solutions that meet all financial needs of the current time.

Contact us for a complete walkthrough on how we devise the right solution for your financial business.